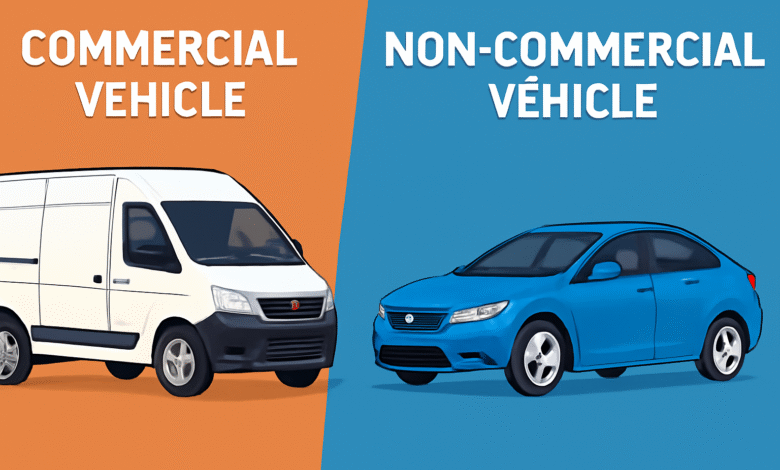

Commercial Vehicle vs Non-Commercial Vehicle: Understanding the Key Differences and Implications

A Comprehensive Guide to Commercial and Non-Commercial Vehicles in the UK

Introduction

In the UK, the distinction between a commercial vehicle and a non-commercial vehicle is vital for compliance with road laws, taxation, and insurance regulations. These classifications determine the types of vehicles used for business purposes or personal use. While both serve essential roles, understanding their differences, particularly in terms of gross vehicle weight (GVW), taxation, and insurance requirements, is crucial. This article explores the key differences between commercial and non-commercial vehicles, covering everything from vehicle types like trucks and vans to tax purposes and licensing requirements.

What is a Commercial Vehicle?

Definition and Purpose

A commercial vehicle is primarily designed or used to transport goods or passengers for a fee as part of a business operation. This includes a wide range of motor vehicles used for business purposes, such as pickup trucks, vans, and trucks. These vehicles are essential for businesses, enabling the transportation of goods and services. Commercial vehicles are designed to handle higher payload capacities, cargo, and heavy-duty tasks that typical personal vehicles cannot manage.

Key Types of Commercial Vehicles

-

Light Commercial Vehicles (LCVs): These include vans and pickup trucks used for business purposes, typically with a gross vehicle weight (GVW) under 3,500 kg. LCVs are widely used by businesses, such as courier services or tradespeople, for transporting goods and equipment.

-

Heavy Goods Vehicles (HGVs): Commercial trucks and lorries, which are generally classified as commercial vehicles, typically exceed 3,500 kg in weight and are used to carry large amounts of cargo or materials.

-

Dual-Purpose Vehicles: These vehicles can be used both for business purposes and personal use. While they might serve business functions, they are not strictly commercial vehicles unless used primarily for business.

Commercial Vehicle Regulations

When a vehicle is used for business purposes, such as transporting goods or passengers, it is usually required to meet specific licensing standards. For example, a commercial driver’s license (CDL) is needed to operate a commercial motor vehicle (CMV) like a large truck or a van with a high gross vehicle weight rating (GVWR). Additionally, these vehicles are typically subject to higher insurance costs due to their business usage. For tax purposes, businesses may also be eligible for VAT Relief and capital allowances.

What is a Non-Commercial Vehicle?

Definition and Purpose

A non-commercial vehicle is any vehicle used primarily for personal use, such as commuting, leisure, or family transportation. These vehicles are not designed or used to transport goods or passengers for a fee. Non-commercial vehicles include private vehicles, motorcycles, and **personal cars. These vehicles are typically less expensive to insure and are taxed based on their emissions and engine size rather than their commercial use.

Examples of Non-Commercial Vehicles

-

Private Car: A non-commercial vehicle used for commuting or personal travel. It is designed for carrying passengers but does not have the capability or design features required for transporting goods.

-

Motorcycles: These vehicles are also used primarily for personal purposes, including short trips or leisure activities.

-

Electric Vehicles (EVs): While electric vehicles can be used in business settings, when operated for personal use, they fall under the non-commercial vehicle category.

Taxation and Insurance for Non-Commercial Vehicles

Non-commercial vehicles are subject to the standard Vehicle Excise Duty (VED), which varies depending on the emissions and engine size of the vehicle. Unlike commercial vehicles, personal vehicles typically require only basic private vehicle insurance, which is less expensive than commercial vehicle insurance due to the reduced risks associated with personal use.

Key Differences Between Commercial and Non-Commercial Vehicles

Usage and Purpose

The key difference between a commercial vehicle and a non-commercial vehicle lies in their primary use. Commercial vehicles are designed for use in transporting cargo or passengers for a fee as part of a business operation. By contrast, non-commercial vehicles are primarily used for personal transportation and cannot be used for business purposes without additional regulations.

Legal and Tax Implications

-

Commercial Vehicles: These vehicles are subject to strict taxation and licensing requirements. They may require a special driver’s license, and businesses must adhere to rules outlined by the Federal Motor Carrier Safety Administration (FMCSA) or the HMRC in the UK, depending on the region.

-

Non-Commercial Vehicles: These vehicles are generally taxed based on emissions and engine size. They may also qualify for benefits like lower insurance premiums if used for personal purposes only.

Insurance Requirements

The insurance for commercial vehicles is more expensive due to the additional risks involved in transporting goods and passengers for business purposes. On the other hand, private vehicle insurance for non-commercial vehicles typically costs less and is more straightforward.

Commercial Vehicles and Their Role in the Economy

Essential for Businesses

Commercial vehicles, such as vans, trucks, and delivery vehicles, are essential for businesses in the UK. They allow companies to transport goods, from raw materials to finished products. Commercial trucks and vans are used by businesses of all sizes, from local trades to large national retail chains, for efficient and cost-effective transportation.

The Role of Commercial Vans

Commercial vans are one of the most versatile commercial vehicles. Vans are often used for business purposes like delivering goods, transporting equipment, and service calls. Light commercial vehicles (LCVs) make up a significant portion of the UK’s transportation infrastructure, helping businesses operate efficiently while maintaining flexibility.

FAQs

What is the difference between a commercial vehicle and a non-commercial vehicle?

A commercial vehicle is used for business purposes, such as transporting goods or passengers for a fee. Non-commercial vehicles are used primarily for personal use, such as commuting or family activities.

Does a commercial vehicle require special insurance?

Yes, commercial vehicles typically require commercial vehicle insurance, which is more comprehensive and expensive compared to the private vehicle insurance used for non-commercial vehicles.

What qualifies a vehicle as commercial?

A vehicle is considered a commercial vehicle if it is used to transport goods or passengers for business purposes, especially if it exceeds a certain weight or has specific design features for business use.

Do I need a special driver’s license for a commercial vehicle?

Yes, operating commercial vehicles like trucks and vans may require a commercial driver’s license (CDL), depending on the weight and function of the vehicle.

Can I use a commercial vehicle for personal use?

Yes, a commercial vehicle can be used for personal purposes, but it may attract additional taxes and insurance costs, such as the Benefit-in-Kind (BIK) tax for business-owned vehicles used personally.

Conclusion

In conclusion, understanding the distinction between commercial and non-commercial vehicles is vital for businesses, drivers, and vehicle owners. Commercial vehicles, such as vans, trucks, and pickup trucks, are primarily used for business purposes and are subject to specific rules, including higher insurance premiums, special licenses, and tax benefits. Non-commercial vehicles, such as private cars and motorcycles, are used primarily for personal purposes and generally face fewer regulations. Whether for transporting goods or private use, knowing the differences between these vehicle types ensures compliance with UK road laws and tax policies.